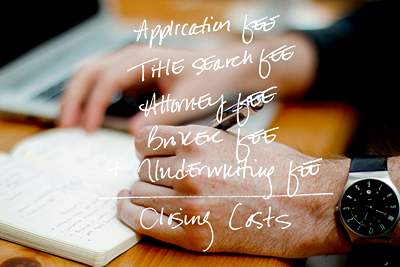

Insurance Closing Costs

There are many insurance closing costs associated with the purchase of real property. We’ve listed them out here for you so you can understand what is involved in a closing and you won’t be surprised when you see these additional expenses.

Homeowner’s Insurance

This insurance covers replacement costs for damages caused by fire, wind or other disaster that might affect the value of the property. Typically, the insurance also includes personal liability and theft coverage.

This insurance covers replacement costs for damages caused by fire, wind or other disaster that might affect the value of the property. Typically, the insurance also includes personal liability and theft coverage.

Flood or Quake Insurance

Additional hazard insurance coverage that is required for homes located in a designated hazard zone as established by the Federal Emergency Management Agency (FEMA). We have the tool to let you know if the property resides in a hazard zone.

Private Mortgage Insurance (PMI)

Insurance required for conventional mortgage loans when the borrower’s down payment on the house is less than 20 percent of the loan value.

Title Insurance

This policy protects both the buyer and lender by insuring a clear chain of title. (In other words, it insures that the person who sells the house has the legal right to do so.)